There are almost as many debt reduction plans as there are ways to get into debt in the first place. So which one is the right one for you? There is no point working on a debt reduction plan that worked for a friend or family member, because their financial situation is not the same as yours. What matters is that you find the right debt reduction plans to suit your income, your debt and your financial situation. It must be right for your unique circumstances. You might decide to use the snowball method, or aim at paying off the highest interest debts first. You could choose to try debt consolidation or even debt settlement options to try and get rid of your debts. Regardless of the type of debt reduction plans you choose, there are some things that hold true for all of them. In order to reduce your debt and get back in control of your finances then here are some things you will need to consider. No More Debt When you?re working on debt reduction plans it?s important not to incur any more debt. This means not charging anything else to your credit cards and not applying for new credit anywhere.

You?re trying to reduce debt, not trick yourself into thinking just one more card won?t matter. It will. Declining Payments You might have noticed that the minimum repayment amounts on most credit card bills are different each month. This is because you?re charged interest on the balance owing. As your balance reduces, your payments should reduce too. If you have any accounts with declining payments, then ignore the amounts as they change. Keep paying the same amount you were paying when your balance was high and you?ll pay it off much faster. More Than Minimum Payments Never pay just the minimum payment on your accounts.

In order to make debt reduction plans work for you and get out of debt for good, you?ll need to find a way to pay more than just the minimum payment due each month. If you?ve chosen the snowball method as your way of getting out of debt, then you?ll only be making excess payments on one debt at a time. As long as there?s extra money going on at least one of your debts, you?re making progress. Motivation The biggest problem with most debt reduction plans is that people lose motivation very quickly and fall back into their bad spending habits that got them into trouble in the first place. Find ways to keep your motivation levels high. You might choose to use a debt reduction spreadsheet to track your progress. Or you might plan a really nice reward for yourself once your debts are gone.

Think about how much money you spend each month on repayments. If all those repayments were gone, what would you prefer to spend that money on? You might treat yourself by having enough money to save for a luxury vacation, or you might find there?s enough left over to save for a down payment on your own home. If you already have a mortgage, you could project your debt reduction plans onto paying this debt down next and work on being completely debt free.

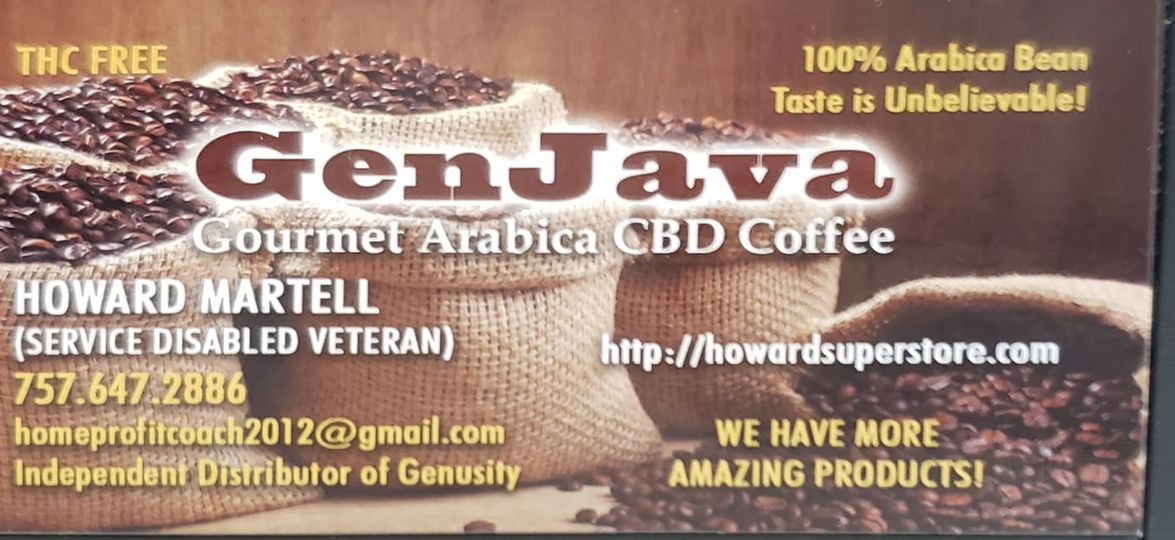

Howard Martell is the Owner of http://HomeProfitCoach.com/tb12 . Check us out anytime for marketing tips and a free subscription to our cutting edge newsletter.