Sometimes you really just find yourself needing some money. Unexpected events such as a car breakdown can put a damper in your budget no matter how well you plan. In situations where you need money and need it quick, you can look into Borrowing money from your 401 K. Typically, when someone makes a 401k plan they do not expect to take any money out of it until it has grown and matured. But life does not always go the way we hope and sometimes we need to delve into whatever source of money we can find, and sometimes that means taking money from our 401k. This has been thought of and that is why most 401k plans will actually have that type of loan available.

While taking a loan from your 401k can often make the difference between paying off a bill and falling further into debt, there are risks involved. If you do not handle the loan carefully you can not only run the risk of having to pay much more down the road, but you also run the risk of ruining your 401k. Not all 401k plans are the same and so there is no universal method for getting money out of them. You need to check into the specific plan you have and find out what restrictions apply when

Borrowing money from your 401 K. For most plans they will require that you borrow a minimum amount of money, usually anywhere from five hundred to a thousand dollars. They often will also have a maximum amount that you can borrow, usually around fifty thousand dollars. However, again, every plan is different so you will need to look and see whether this applies to you or not. While taking money from your 401k plan may be a lifesaver, you may not be able to. While most plans are different, there are usually similarities in the form of requirements. Most plans will not let you borrow money from them unless you can meet the requirements they put in place.

If you do not meet these requirements they will not lend you the money. So this is another reason for why you should look over your plan carefully and read the fine print so that you are properly educated. Like most loans, a loan from your 401k will have a set repayment plan that you will have to adhere to. This can be anywhere from 5 to 15 years depending on what type of loan you took out and what type of plan you are on. The nice thing about Borrowing money from your 401 K is that, while you of course have to pay it back, the interest rates are fairly low and are actually put back into your 401k. While taking a loan from your 401k is a good option, there are some additional fees that you may have to pay.

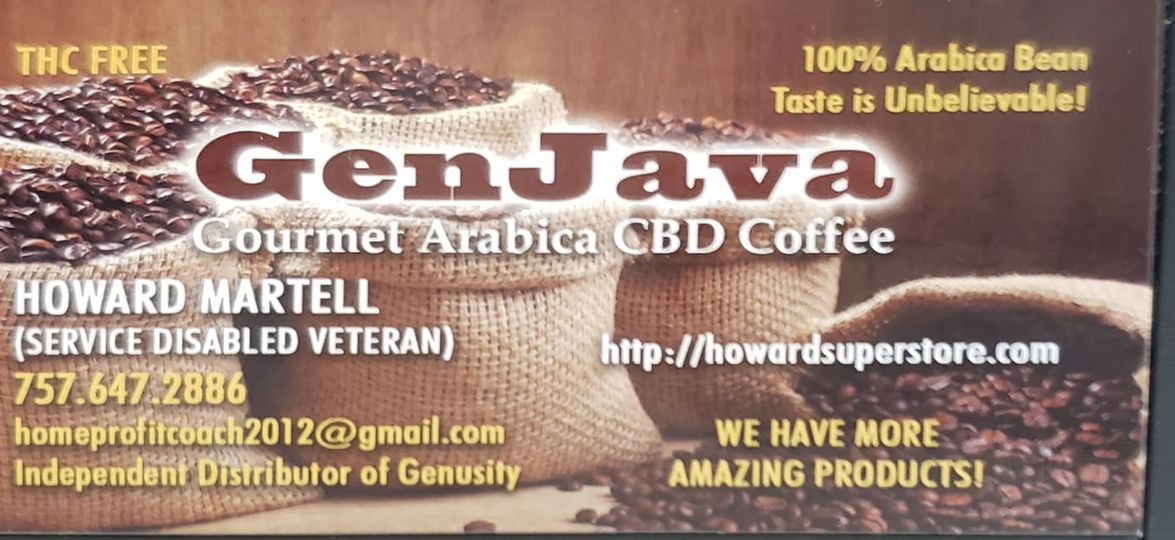

Such as yearly fees or fees if you miss a payment. If your company has someone who manages 401k plans you should talk to them in case you have any questions. Howard Martell is the Owner of http://HomeProfitCoach.com/silver . Check us out anytime for marketing tips and a free subscription to our cutting edge newsletter.