Seeing people buying food or shopping clothes using credit cards has been commonplace these days. The phrase "Charge it!" has become a favorite expression of card users, and has been commonly heard in shops, dining places, and elsewhere. After all, who does not want to use these credit cards? Easy to use, these sleekly-designed cards can be used to buy practically everything in commercial establishments regardless of how much (or less) money does one carry money in his wallet. Short of cash and hungry? No grocery supplies? Going to a party but no money to buy that dress you’ve been drooling for? No problem!

Your good ol’ credit can care of that for you. No worries. Credit Cards: Not Free Money But wait. A credit card spree may be fun, but that doesn’t free you from responsibilities in paying the expenses you incurred from using your credit card. Credit cards, after all, are interest loans in disguise. Typical credit cards ask for a number of charges, including: " A finance charge, which is an interest charge for the unpaid portion of your monthly bill; " An annual membership fee; " Or if you’re paying after the deadline, there is also a late payment fee which could have a higher interest rate. In fact, many credit-card holders face credit-related problems. Poor purchasing decisions, lack of information on credit card fees, and disregard for upcoming credit payments are among the reasons why many credit-card users are often hard-pressed in paying their debts. Some are not even able to pay for the actual purchases they made, just barely managing to pay credit card company charges. Before you get drowned in a sea of debt, here are some tips to help you manage your credit-related expenses:

" Be credit smart. Applying for a credit card application means you are ready to assume the responsibility for paying your credit. You and only you – not your parents, spouse, or whoever – is responsible for that. " Use your credit cards wisely and sparingly. Remember: Paying goods and services using credit cards are more expensive than using cash or checks. Credit payments include interest and other fees. Use credit cards as sparingly as possible. If you really need to use credit cards, carry only the cards that you will actually use. " Use credit only if you are sure you can repay it. Paying your debt on a credit card using another does not count. " Avoid impulse shopping on your credit card. "

Use credit for money emergency only. " Seek credit counseling as soon you see financial problems on the horizon. CPP_author

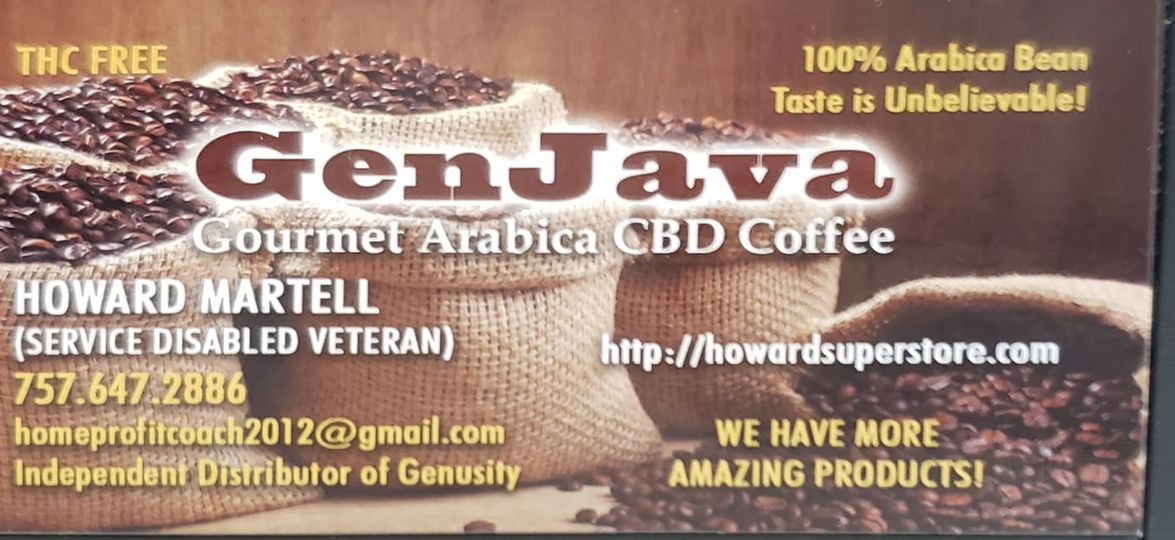

Howard Martell is the Owner of http://HomeProfitCoach.com/topnotch . Check us out anytime for marketing tips and a free subscription to our cutting edge newsletter.